TAX ENGINE

Understand the Tax Implications of Every Move

Our in-house team of tax experts continuously monitor the latest tax laws to support your mobile employees around the world.

Comprehensive Coverage To Support Your Entire Global Workforce

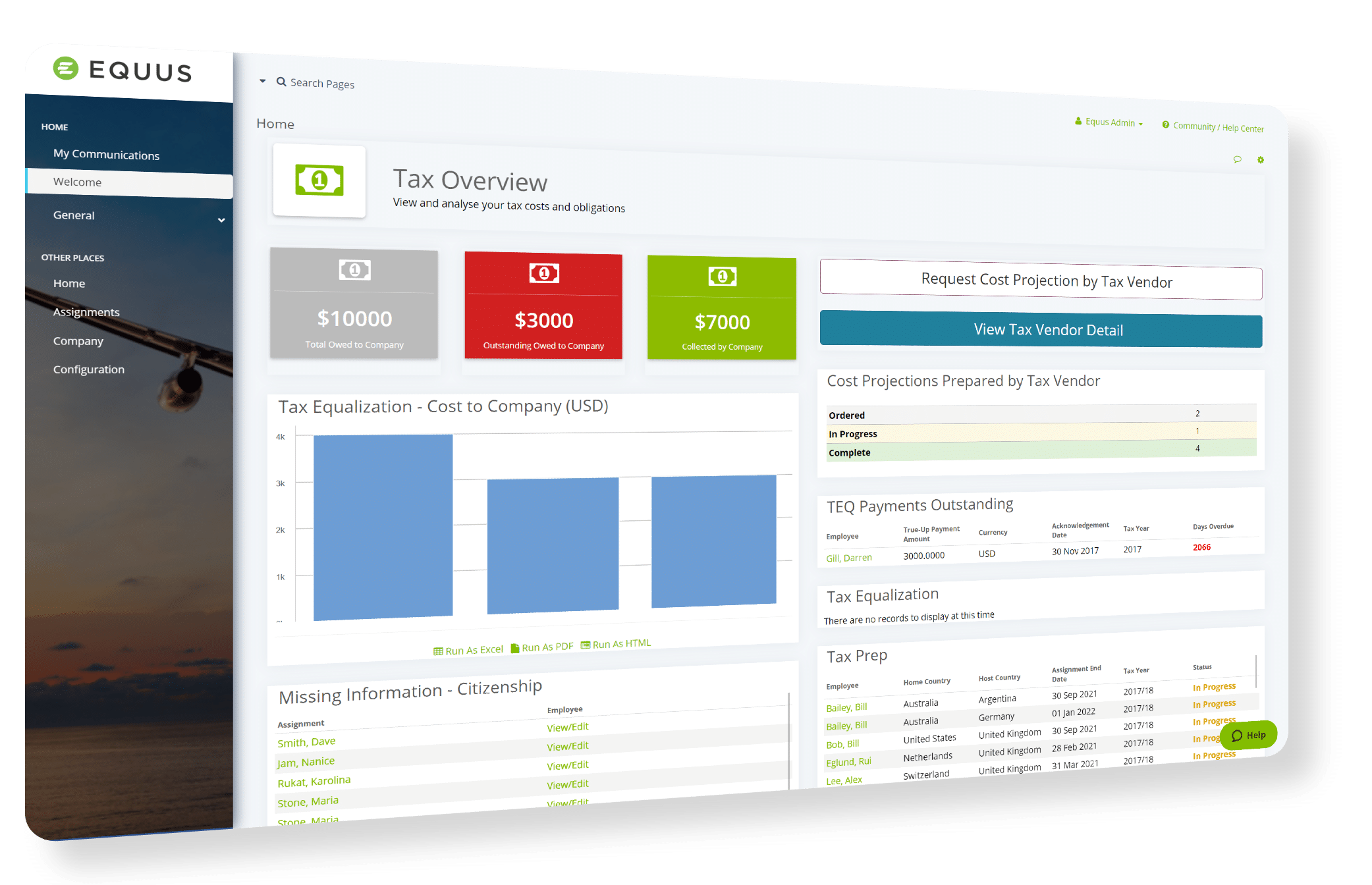

Streamlining Global Tax Management

The Equus Tax Engine powers cost estimates, balance sheets, and compensation calculations to help you mitigate financial risk, eliminate surprises, and stay compliant. It supports all types of tax policy, from hypothetical taxes for tax equalized policies to gross-up taxes for host-based and permanent moves, and everything in-between.

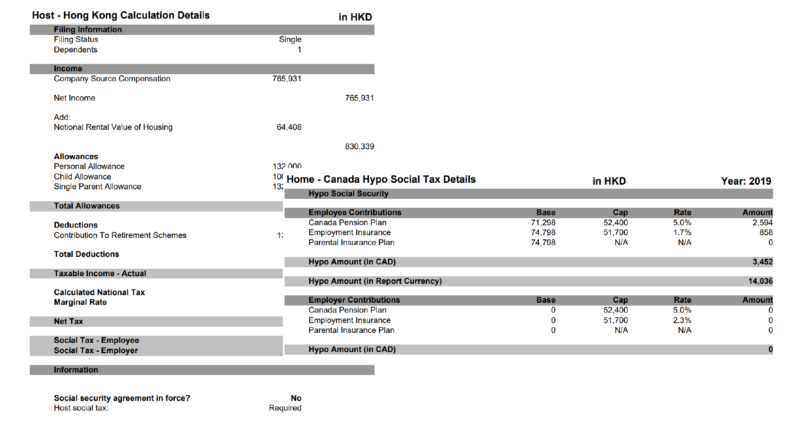

Detailed Tax and Social Security Reporting

The Equus Tax Engine supports short term income tax treaty relief, social security agreements and transparent tax calculation detail reporting.

Additionally, country specific concessions and reliefs can be set to apply per company policy and/or changed at an individual level.

Experience You Can Rely On

Our in-house team of tax professionals continuously monitor, enhance and update the Engine to reflect current tax law in authorities around the world. With over 100 years of combined tax experience and a number of professional qualifications including American CPA, British CA and ITP, and Canadian CPA-CA, our team has the expertise needed to interpret complex tax issues promptly and deliver great tax software fast.

Client Spotlight

Continental Moves to a New Tax Engine

Having confidence and agility is crucial when managing global tax. Learn how Continental effectively moved to the Equus Tax Engine for more cost savings, flexibility, and control.

“Prior to changing to the Equus Tax Engine, the Continental Global Mobility team was typically using tax data that was one year old with very few ways to customize for modern family arrangements and special situations. Since we were changing data providers for cost of living, location, housing and travel data in large part without grandfathering, it was a unique opportunity to also change to the Equus Tax Engine at the same time for all assignees. So with the trust of the experienced Equus tax team and our Equus account team, we went for it.”

Head of GPS Global Mobility Services Americas, Continental

Support Your Organization's Global Success

Get your entire mobile workforce moving with one, comprehensive platform.