Take Control with Equus

From simplifying compliance and vendor management to empowering employees and making data-driven decisions, our global mobility solutions help elevate the success of your program, and your business.

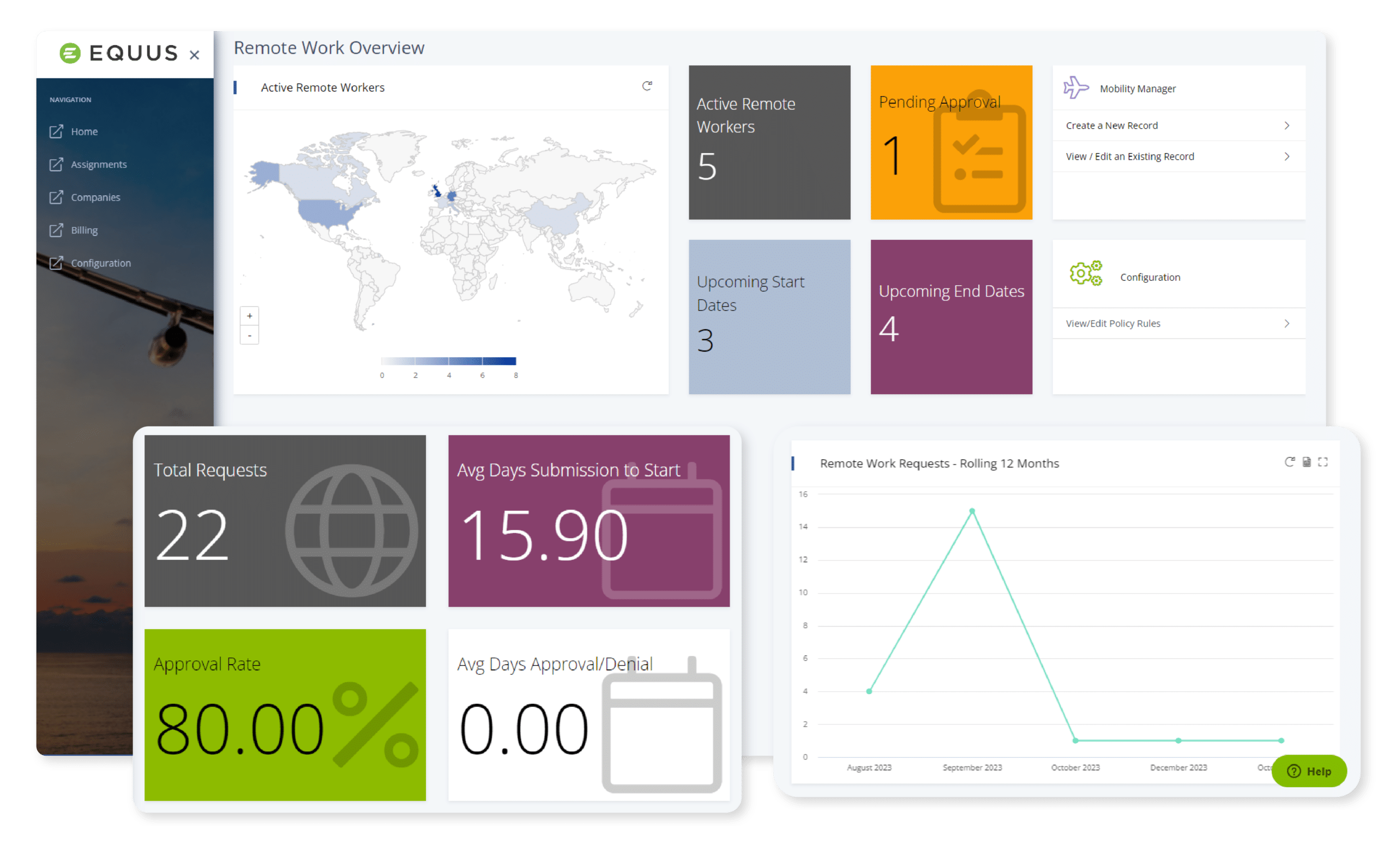

Remote Work

Remote Work

Capture remote working requests with ease using the Equus Platform's request form. Save time by auto-approving or denying requests based on your company's policy, or automate approval notifications to relevant stakeholders. Integrate your HR systems and service providers, giving you a single source of data, and giving your employees a simple and intuitive experience they expect.

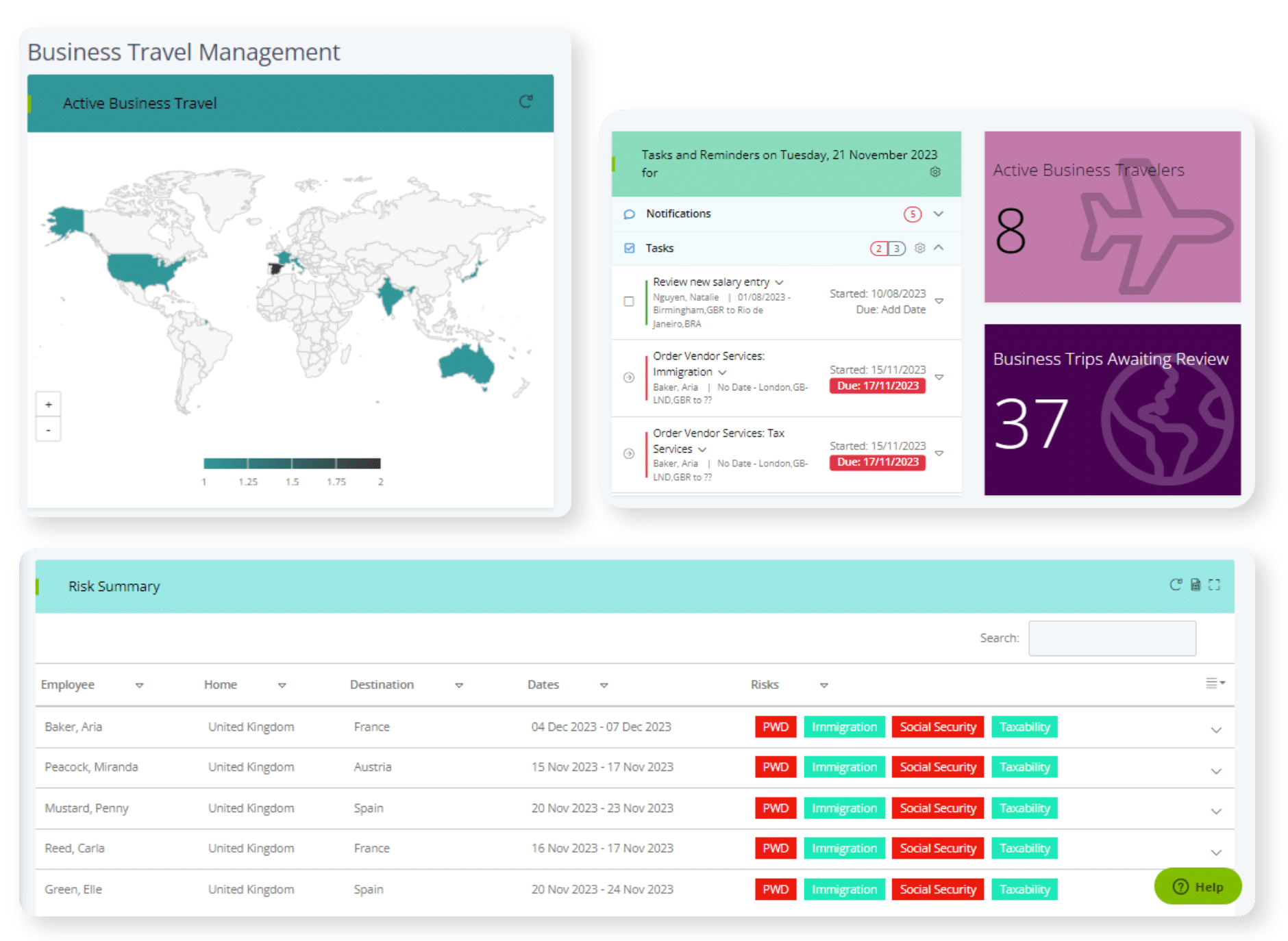

Business Travel

Business Travel

The Equus Platform makes it easy for organizations to track and manage their traveling employees. Readily report on the whereabouts of your business traveler population with real-time insights, while also tracking immigration and tax thresholds.

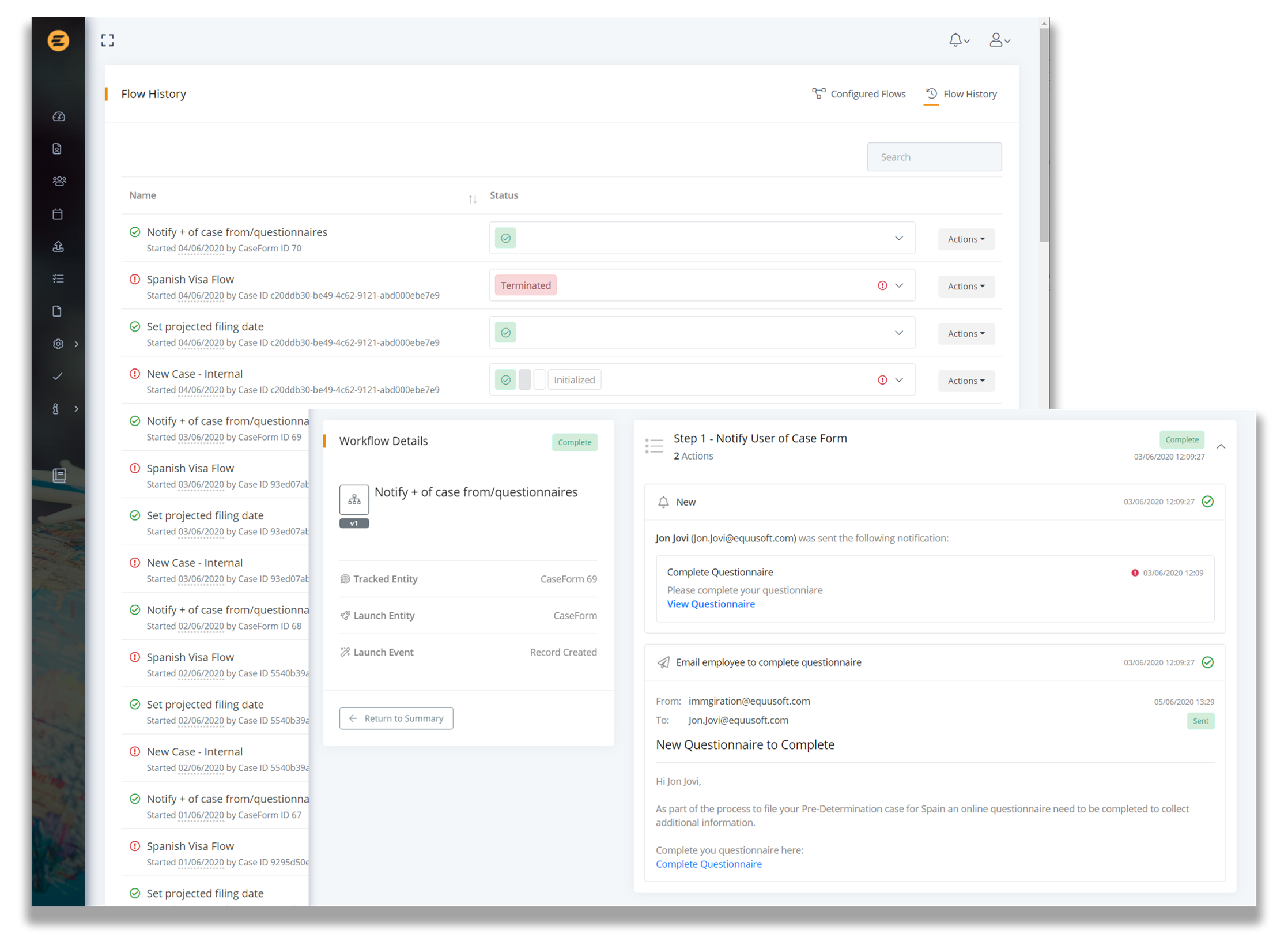

Immigration

Immigration

Automate how you initiate, track and manage immigration cases with the Equus Platform. Our Immigration solution streamlines processes, ensures compliance, and supports your employees throughout their immigration journey.

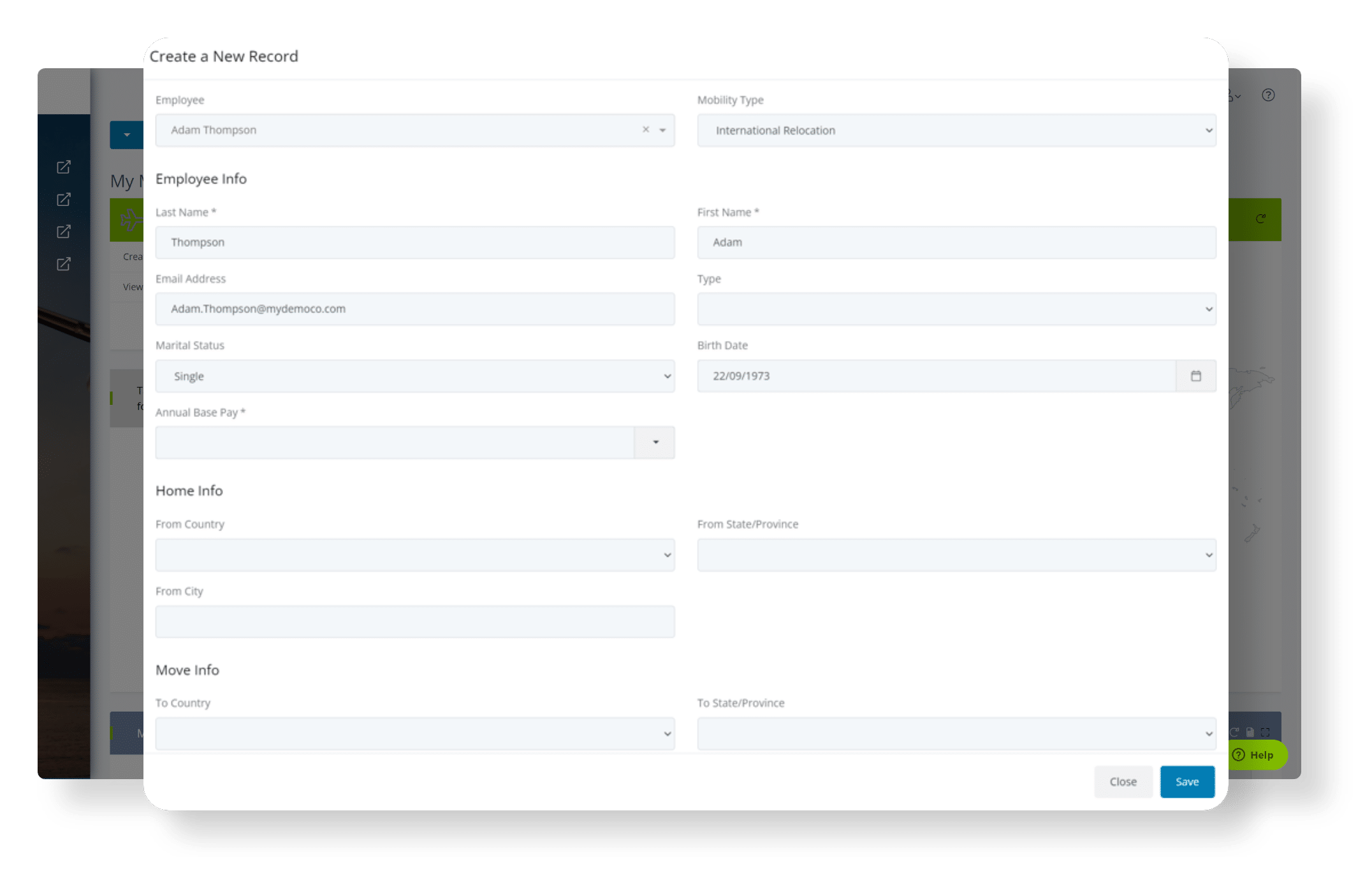

Relocations

Relocations

Say goodbye to complicated, time-consuming processes and embrace the future of employee relocation management. Seamlessly handle all aspects of international and domestic employee relocation, leaving you free to focus on what matters most – your people.

Intl New Hires

International New Hires

Simplify the complexity of international onboarding. We provide a centralized platform that guides new hires through the onboarding journey, no matter where they are located.

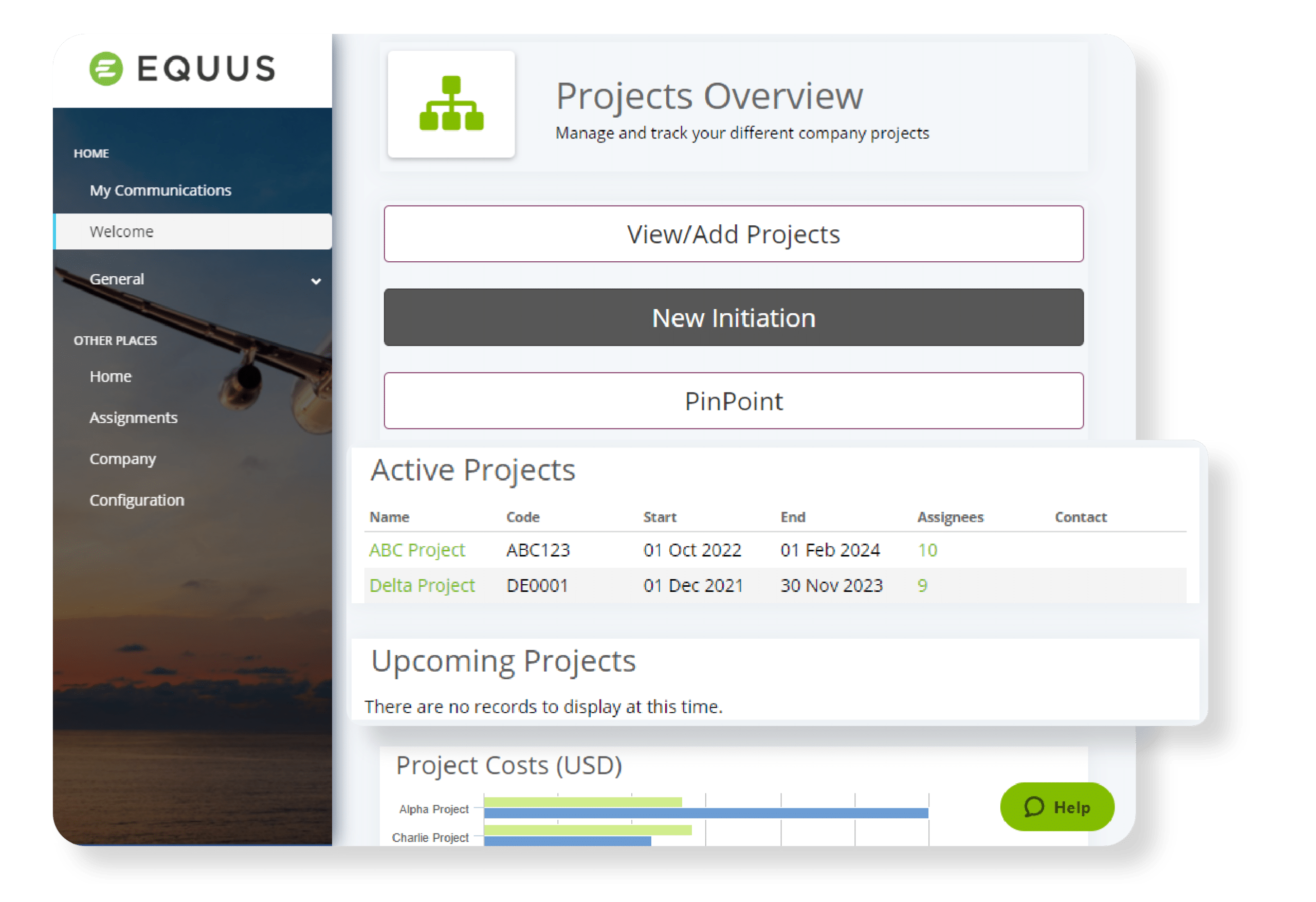

Project Work

Project Work

The Equus Platform is designed to seamlessly handle all aspects of permanent international and domestic employee relocation, leaving you free to focus on what matters most – your people.

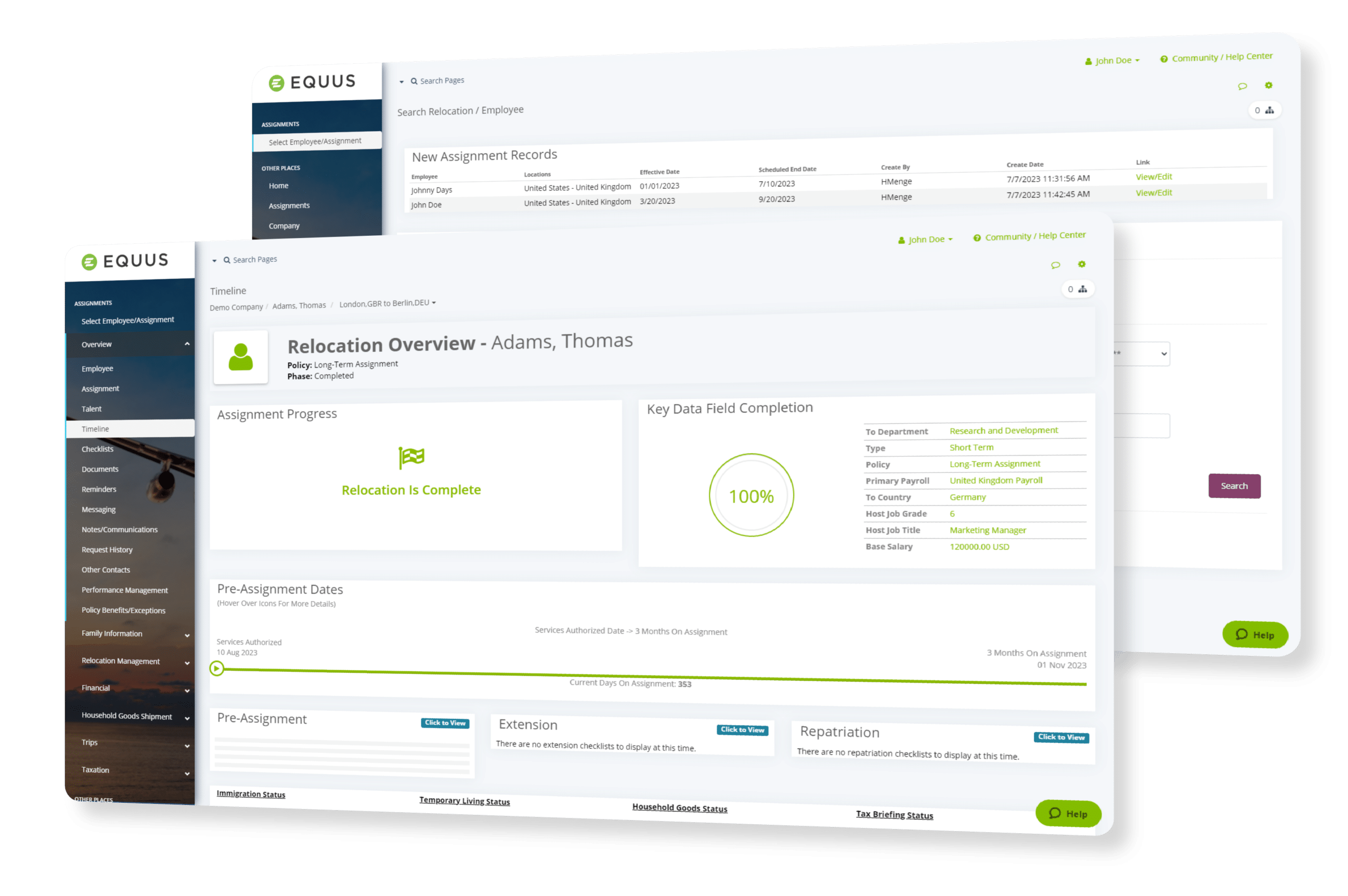

Assignments

Assignments

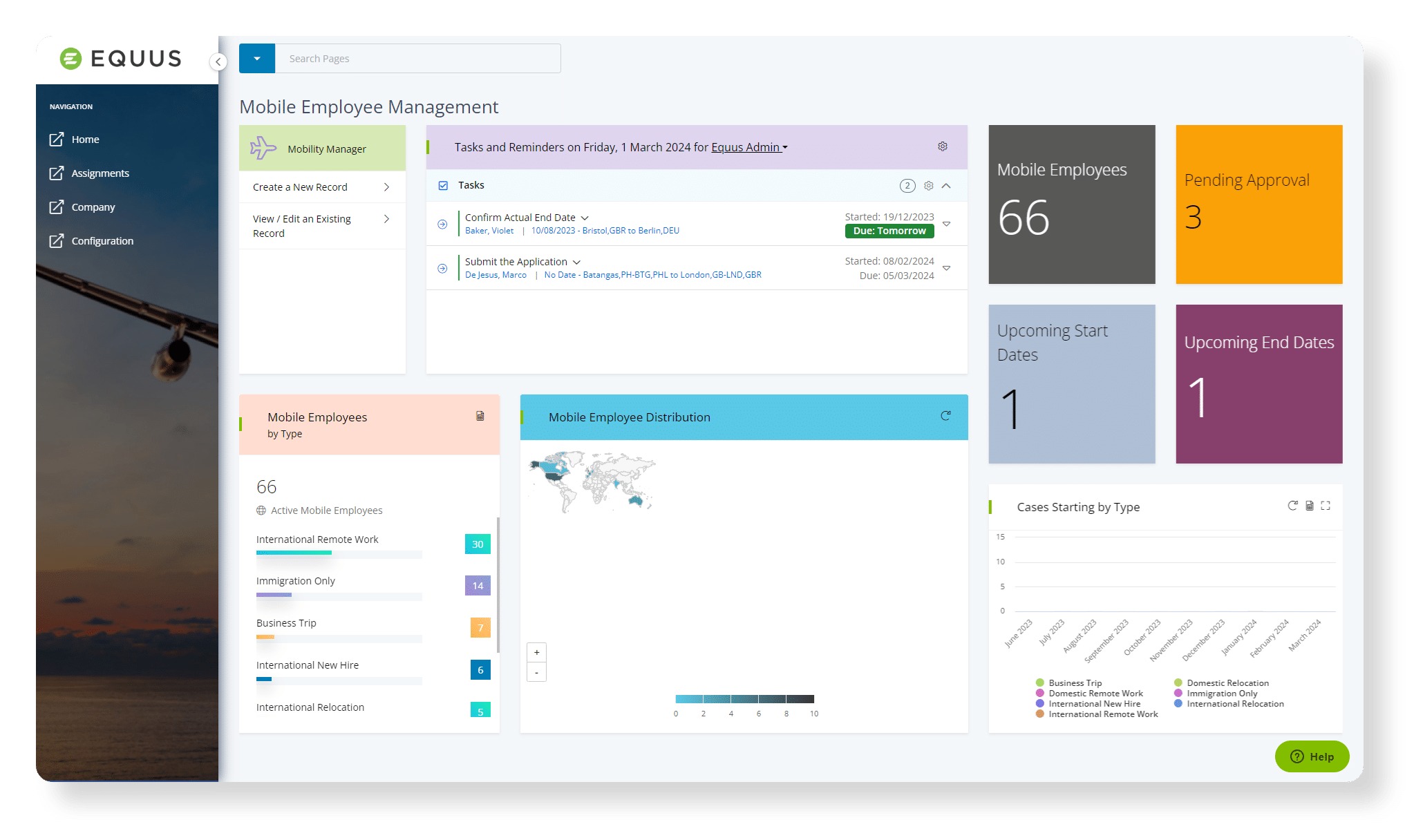

The Equus Platform provides a centralized app to plan, track and manage assignments efficiently. Define assignment policies, including compensation, benefits, immigration and tax, while considering compliance with local regulations.

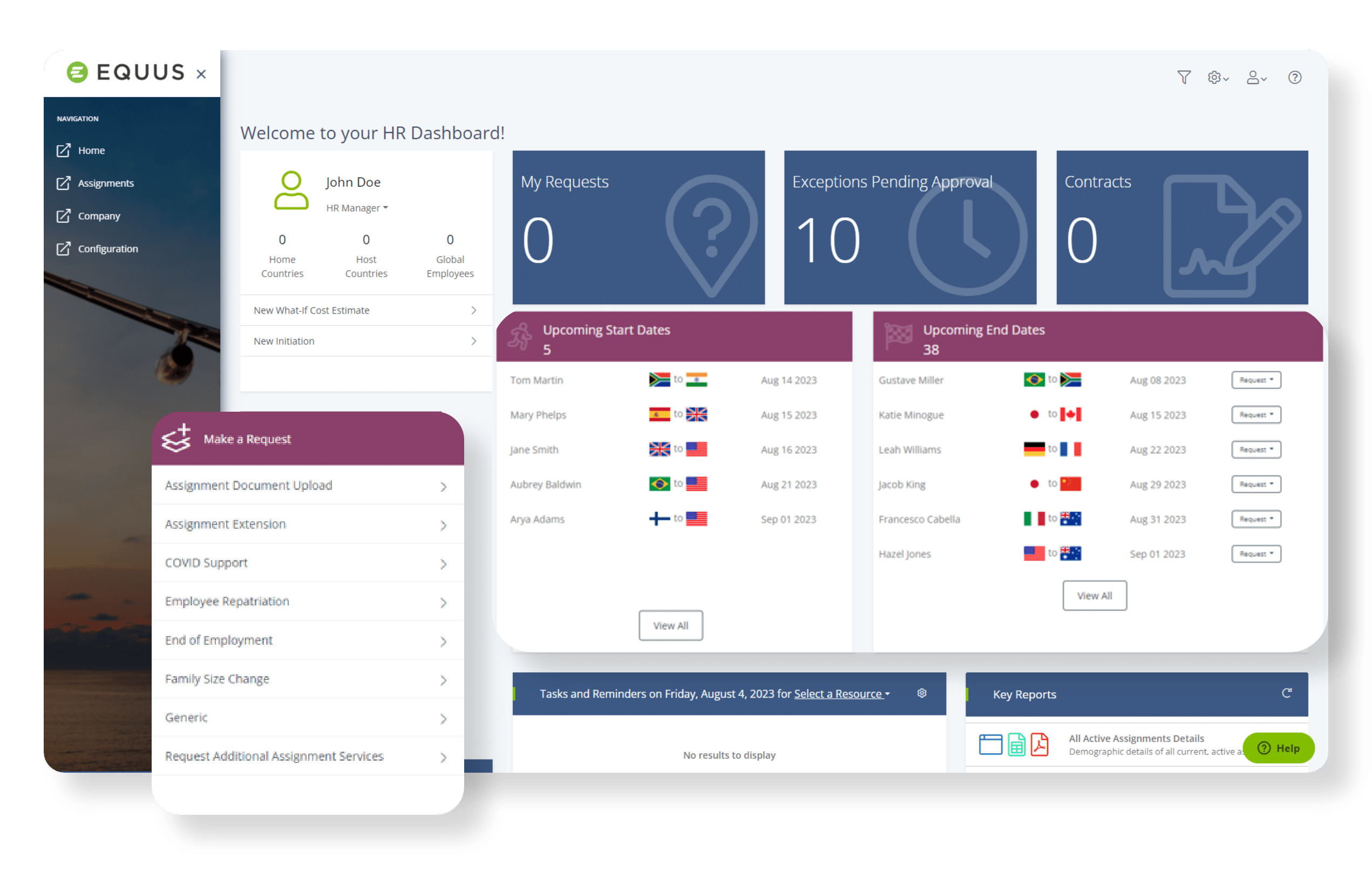

Discover the Power of the Equus Platform

GLOBAL COMPLIANCE

Mitigate Risk

The Equus Platform keeps you updated on regulatory changes and ensures your mobility programs adhere to local laws and tax regulations. Rest easy knowing your organization is compliant and protected.

COMP & PAYROLL

Ensure Accuracy

Get accurate compensation calculations and global payroll reporting with the Equus Platform. Seamless integration between mobility and payroll systems ensure an error-free compensation process.

VENDOR MANAGEMENT

Improve SLAs

Equus helps you to streamline your relationships across all vendors involved in your mobility ecosystem. Simplify communication, track performance, and optimize vendor selection, all in one unified platform.

DATA & ANALYTICS

Be Data-Driven

Access powerful reporting tools and valuable insights into your workforce mobility with the Equus Platform. Make informed decisions, identify trends, and track KPIs to optimize your talent mobility strategies.

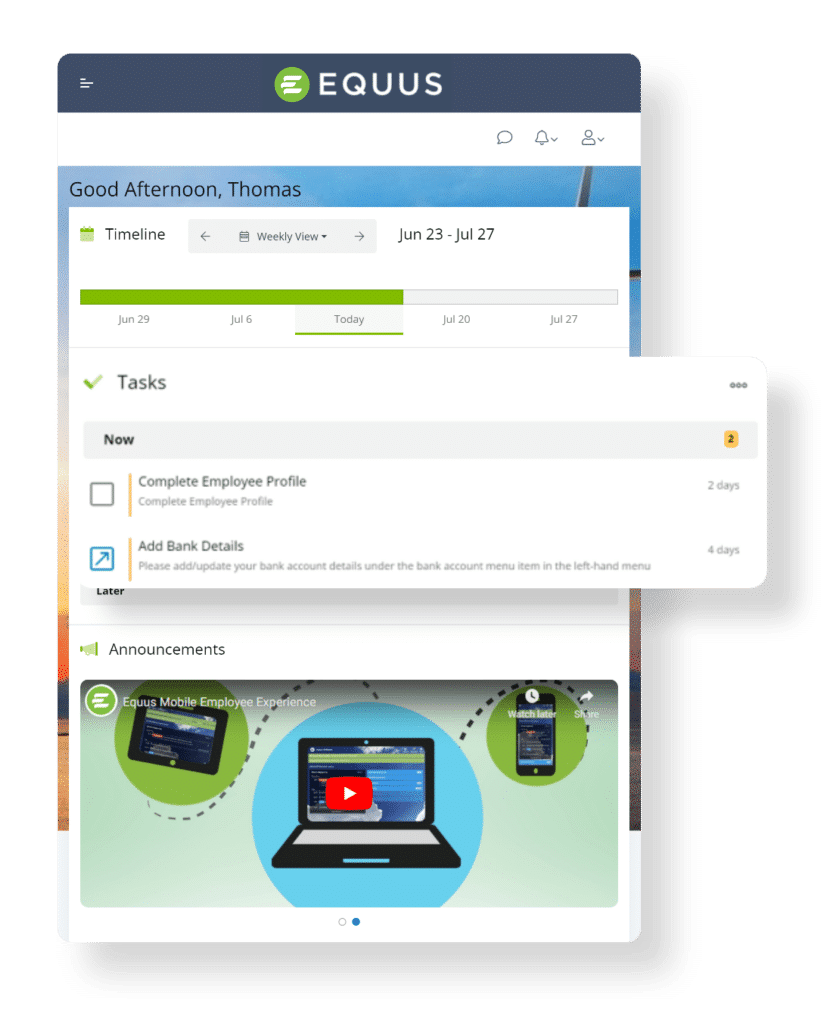

Tracks key dates, tasks and deadlines. Permits assignees, mobility teams, vendors and stakeholders to update action items and checklists, giving everyone real-time status visibility.

Tracks key dates, tasks and deadlines. Permits assignees, mobility teams, vendors and stakeholders to update action items and checklists, giving everyone real-time status visibility.

Roles-based access to all vital move-related documents, centralized for easy retrieval by those who need them.

Roles-based access to all vital move-related documents, centralized for easy retrieval by those who need them.

Lists all services available to the assignee per their approved Policy and makes details available at the click of a button.

Lists all services available to the assignee per their approved Policy and makes details available at the click of a button.

Tracks the status of submitted expenses and payments, while making it easy for employees to file expense reports in a timely manner.

Tracks the status of submitted expenses and payments, while making it easy for employees to file expense reports in a timely manner.

Displays all compensation statements so employees have a full understanding of their pay, including compensation calculation and

Displays all compensation statements so employees have a full understanding of their pay, including compensation calculation and

worksheets.

Get in-depth destination information and robust cultural learning tools to help alleviate the stress of an international relocation.

Get in-depth destination information and robust cultural learning tools to help alleviate the stress of an international relocation.

EMPLOYEE EXPERIENCE

Empower Employees

Give your employees personalized service, relevant data, and easy access to critical information. Our platform enhances the mobility journey and fosters a positive and efficient experience for employees on the move.

Connect Your Mobility Ecosystem

The Equus Ecosystem is an integration network that brings all the people, processes and data together in a single system of work for greater analytical insights, increased efficiencies, and an improved employee experience.

How JTI Streamlined Payroll with Equus

Take Control of Your Organization's Global Success

Get your entire mobile workforce moving with one, comprehensive platform.