For many tax professionals in the United States, the first quarter of the year marks the start of their “busy season,” with a fast-approaching April 18, 2022, filing deadline for individual tax returns. At Equus, our in-house tax team has just wrapped up our “busy season” after releasing versions 21.6 and 22.1 of the Equus Tax Engine, delivering a total of 114 updates for 94 authorities (including 60 countries and 34 sub-authorities).

Most of these updates address changes effective January 1, 2022, for countries with a calendar tax period. All but eight of the ninety-five Equus Tax Engine-supported countries use a calendar year to measure individual taxpayers’ income to impose tax. Equus aims to deliver tax updates in a release close to their effective dates, enabling our clients to use current tax data to project assignment costs using Cost Estimate and prepare balance sheets and pay packages using Compensation Calculation in AssignmentPro.

Most of these updates address changes effective January 1, 2022, for countries with a calendar tax period. All but eight of the ninety-five Equus Tax Engine-supported countries use a calendar year to measure individual taxpayers’ income to impose tax. Equus aims to deliver tax updates in a release close to their effective dates, enabling our clients to use current tax data to project assignment costs using Cost Estimate and prepare balance sheets and pay packages using Compensation Calculation in AssignmentPro.

Busy season for our in-house tax team began in October, as we monitored the progress of tax legislation around the world, typically a part of countries’ annual budgeting processes. The primary purpose of taxation, after all, is to fund government programs.

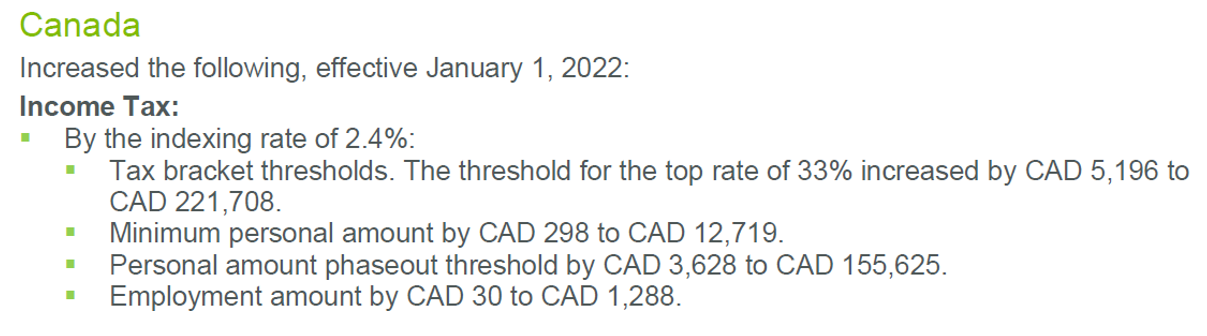

Countries rely on a lawmaking process to introduce changes to tax law. Some countries, like Canada and the United States, also have built annual inflationary adjustments into existing tax rules. These adjustments impact tax bracket and deduction thresholds and are linked to a consumer price or similar index. The tax team increasingly leverages such indices to deliver more of these annual updates on a timely basis.

Look for release notes explaining the use of an index, like this one for Canada in release version 21.6:

Although our annual busy season is now behind us, the tax team is still hard at work keeping the Tax Engine current. We continue monitoring for tax updates around the world, including for non-calendar tax year countries such as Australia and India.

In addition, we are also taking advantage of this time before the next busy season is upon us to increase the Tax Engine’s functionality and useability. The tax team is now focused on delivering new features and enhancements such as for European frontier workers. Clients can learn about our current release plan by following the Equus Tax Engine – Upcoming Tax Updates in the AssignmentPro Help Center or by attending the Equus Tax Engine release webinar!